2025 Mfj Standard Deduction

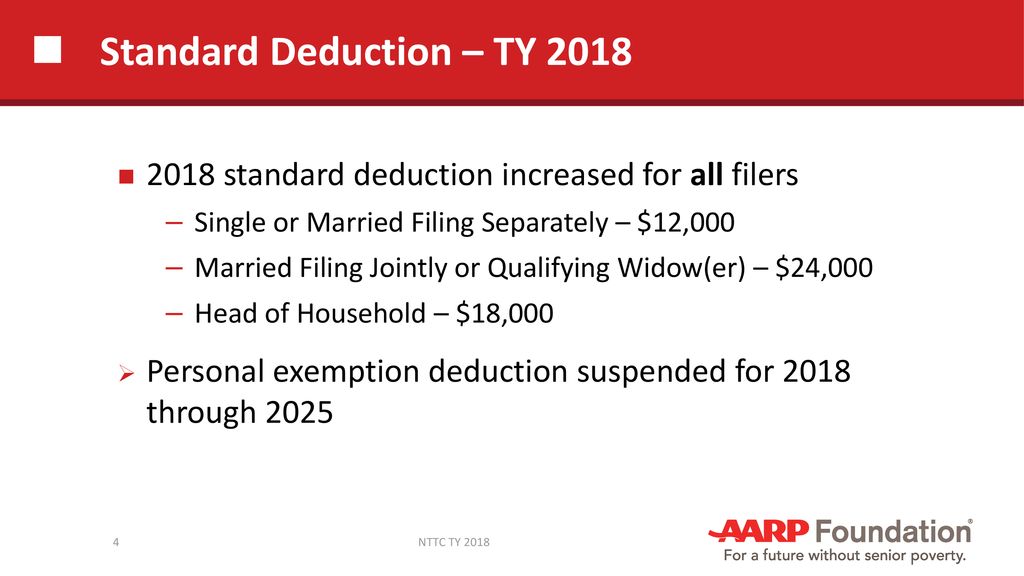

2025 Mfj Standard Deduction - Filing Status and Standard Deductions for U.S. Citizens London, You pay tax as a percentage of your income in layers called tax brackets. The tax cuts and jobs act nearly doubled the standard deduction and eliminated or restricted many itemized deductions in 2025 through 2025. TAXAIDE Changes to Arizona Tax Law Instructor ppt download, It also eliminated the “pease” limitation on itemized deductions for those. A breakdown of the impact of the individual.

Filing Status and Standard Deductions for U.S. Citizens London, You pay tax as a percentage of your income in layers called tax brackets. The tax cuts and jobs act nearly doubled the standard deduction and eliminated or restricted many itemized deductions in 2025 through 2025.

2025 Mfj Standard Deduction. The 2025 standard deduction for tax returns filed in 2025 is $14,600 for single filers, $29,200 for joint filers or $21,900 for heads of household. Your standard deduction consists of the sum of the basic standard.

Standard Deduction Qualified Business Deduction ppt download, The 2025 standard deduction for tax returns filed in 2025 is $14,600 for single filers, $29,200 for joint filers or $21,900 for heads of household. The tax cuts and jobs act nearly doubled the standard deduction and eliminated or restricted many itemized deductions in 2025 through 2025.

New Legislation Individuals Chapter 1 pp ppt download, Your standard deduction consists of the sum of the basic standard. The standard deduction is a fixed dollar amount that reduces your taxable income.

Tax Brackets 2025 Irs Nadya Valaria, View the chart below to see how your tax bracket may be. If you earned $75,000 in 2023 and file as a single taxpayer, taking the standard deduction of $13,850 will reduce your taxable income to $61,150.

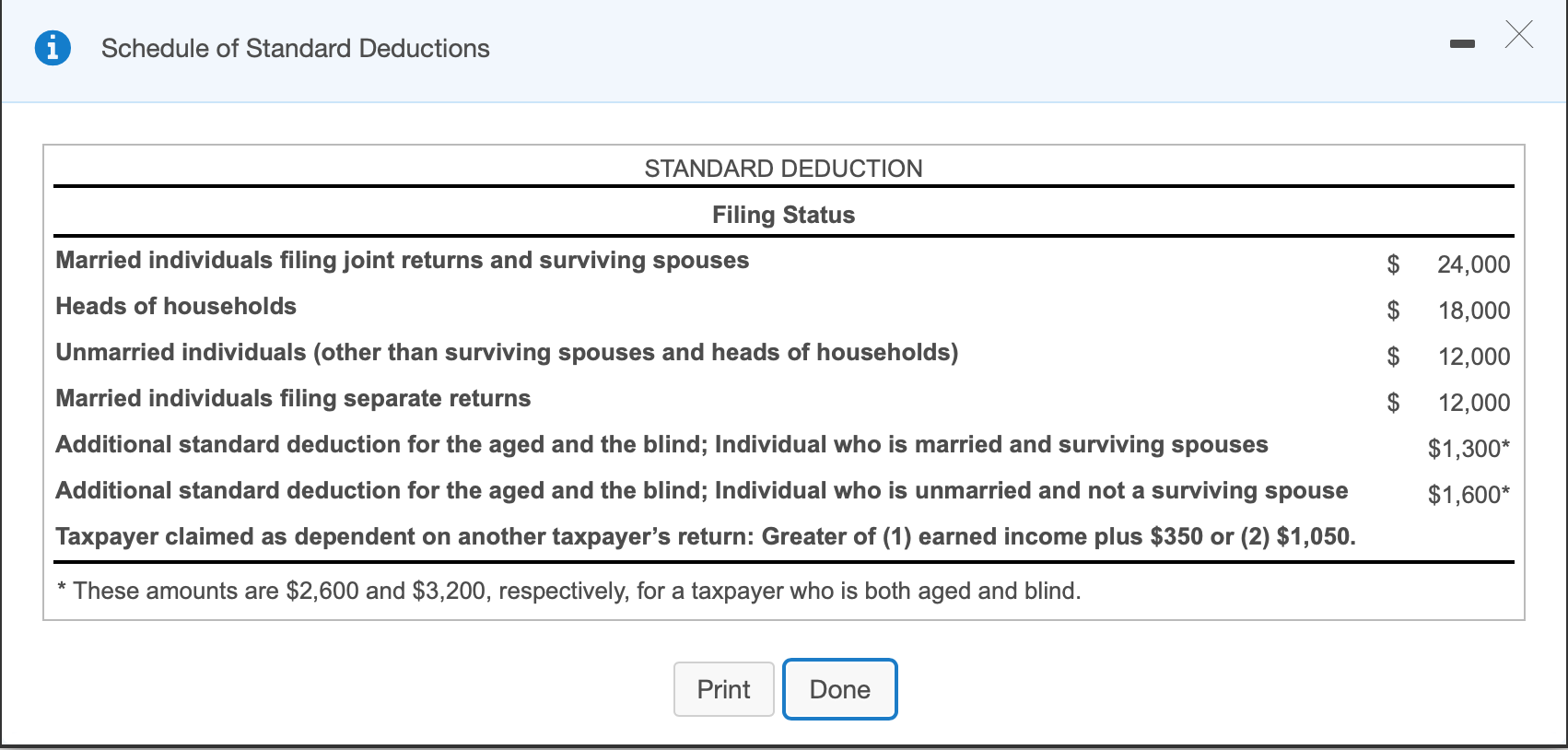

People who are age 65 and over have a higher standard deduction than the.

The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an.

Tax Law Changes 2025 Release 2 Slide changes ppt download, The standard deduction will be cut almost in half and the child tax credit will be reduced. The tax cuts and jobs act nearly doubled the standard deduction and eliminated or restricted many itemized deductions in 2025 through 2025.

Standard Deduction Mfj 2025 Dode Nadean, The standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. You are filing as married filing jointly and one of you is age 65 or older so an additional $1,500 is added to your standard deduction.

For 2023, the federal standard deduction for single filers was $13,850, for married filing jointly it was $27,700 and for the head of household filers, it increased to.

The standard deduction will be cut almost in half and the child tax credit will be reduced. 2025 standard deductions and tax brackets helene kalinda, the standard deduction is increasing by more than 5% for 2025 income tax returns, which will be filed in 2025.

Tax Policy Center on Twitter "A House GOP tax plan would raise the, Section 63(c)(2) provides the standard deduction for use in filing individual income tax returns. For example, if the standard deductions are greater than your taxable income, you would not have taxes due.

People who are age 65 and over have a higher standard deduction than the.